Investments

Investments

When is the right time to invest?

This is a question that I get asked alot. I used to ask myself this question many times as well.

You said…

Market is too high, you will buy when it crashes.

Market crashes, you said the worst is not over.

Market recovers, and you said it is a dead cat bounce.

Market breaks new high, and you said it is expensive.

Sounds familiar?

Look, the market is never the problem.

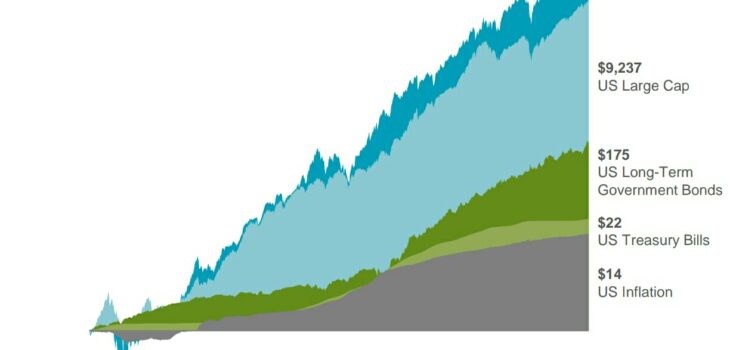

You will never know the right time, just like you never know when the whale will jump out of the water to let you take that perfect shot. However, evidence investing shows that decades after decades of investing, the markets will only continue to go higher over time, punctuated with a few recessions from time to time. But markets always go up over the long term.

Instead, determine your personal goals and time horizon and allow us to construct a CORRE portfolio with an asset allocation according to that.

Indeed, it is hard to time, just buy the entire market across the globe with the ability to get higher expected returns. Then, sit back, enjoy your coffee and focus on your life dreams!

If you really still need an answer to the question… If you had started to invest into a CORRE portfolio at least 10 years ago, you would be kicking yourself for not doing anything despite the swings of the markets. This statement would have been true 98% of the time.

Let time and I be your best friend.